From engineering to P&L

Power density changes outcomes you can measure in financial statements. A stable thermal envelope supports safe overclocking, which raises TH (Tera Hash) per miner and lowers unit count at a given PH (Peta Hash) target (capex↓). Stable temps and no dust ingestion extend useful life and reduce repair/replacement cadence (lifecycle↓). Industrial-scale cooling reduces outages and throttling (yield↑). These small gains don’t add, they compound across capex, opex, uptime, and lifecycle.

Real field outcomes Rosseau has demonstrated (numbers that matter)

When power density is delivered at scale, the financial impact is concrete:

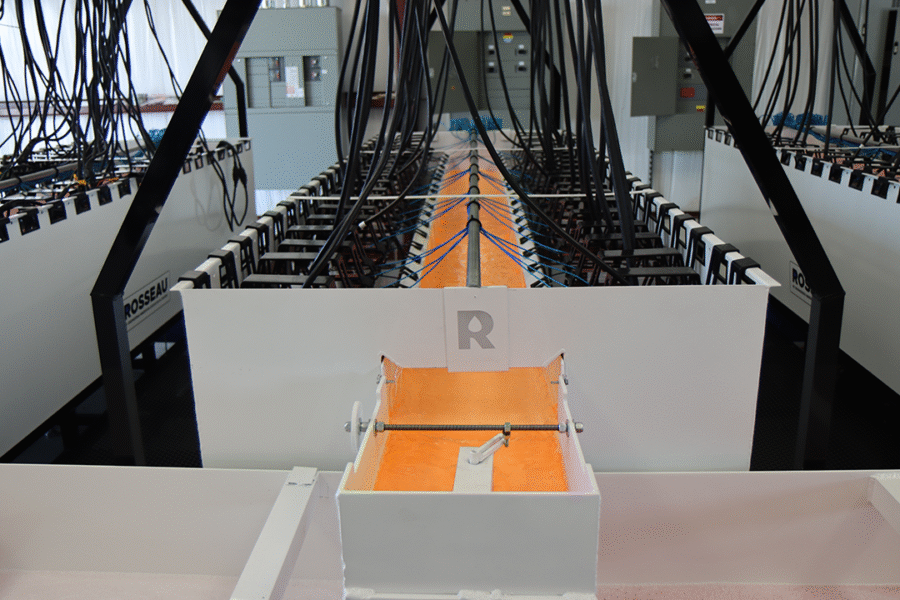

- A Rosseau One system holds 320 WhatsMiner M66S+ miners and can deliver 135 PH when miners are safely overclocked to 422 TH/s, versus OEM stock modes around 294 TH/s. That’s a 44% overclock per miner which materially improves bitcoin production.

- For a 135 PH deployment this reduces units required from 462 miners (M66s+ OEM stock) to 320 miners (Rosseau overclock mode) providing a ~31% miner capex reduction while generating the same amount of hash rate

- Rosseau field/analysis shows dramatically lower downtime: industry average annual miner downtime ≈ 8% (≈30 days) vs Rosseau immersion <1% (≈3.5 days). That downtime delta converts to six-figure revenue losses per year across just a few hundred devices.

- Rosseau’s deployments extend ASIC useful life to ~5–6 years versus an air-cooled baseline of ~3 years in our comparative models, eliminating the typical 3-year replacement churn and its associated capex shock.

These are not marketing hypotheticals: They are field-derived outcomes and customer test results with next-gen hardware.

A compact financial illustration (why small % improvements compound)

Using the Rosseau example data above: fewer miners required + longer useful life compounds into huge capex and revenue protection benefits.

In the example used in our field materials, combining safe overclocking and extended life cut the effective cost per TH by roughly a third and removed multi-hundred-thousand dollar replacement and downtime hits over a 3–5 year horizon.

The math is straightforward: You reduce units purchased, eliminate mid-cycle replacement, and increase mined BTC per unit of installed hardware.

Decision checklist (for buyers)

- Insist on sustained density proof, not peak claims.

- Score vendors on thermal stability (variance, ΔT) and lifecycle impacts.

- Model capex, downtime, and replacement cadence over 3–5 years, not one season.

We can help model your economy

Read more about how Rosseau can maximize your mining density. Get our RFQ checklist and a two-slide ROI built on your fleet spec (customized to your miner models, costs and site). We’ll model your economics and create a board-ready analysis.